May the new year bring you both the promise of new happiness and a lot of new achievements in your life. A good way to start the year off right and stay motivated is to have a plan for your personal finances in 2019.

I understand it can be difficult to save money. You don’t know how much you need to save, you have bad spending habits, no support or you feel you don’t have the extra cash to stash away. Well don’t compare yourself to others! Change your mindset about money so you will always have something available in emergency situations. Here is a different and easy approach to reaching your savings goals. It’s called the the 52-Week Money Savings Challenge and I will break down how to get started and how I can help.

Why New Year’s Resolutions Don’t Last

You set goals at the beginning of the year, but by April you’ve already given up or forgotten all about them. Why does this happen? Well you don’t set realistic expectations. Instead of gradually doing things, you go from doing nothing to saying you will do everything. Plus you worry too much about what other people think instead of having a plan that is focused on making you happy.

Why Saving Money is Important

Saving money takes a lot of discipline and sacrifice. According to Bankrate.com, 20% of Americans don’t save any of their annual income and even those who do save aren’t saving much. And are you apart of the 33% of Americans who have $0 set aside for retirement? Saving money can give you freedom, provides financial security and allows you to take calculated risks. Plus if you’re lucky to get old one day you will need money when you’re not able to work.

Saving Money is Difficult

Before you can develop the mindset to keep your money, you need to first understand where your money is going. If you don’t have a budget, create one and if you don’t have financial goals, start writing them down on a notepad today. Be specific, track your spending and begin to understand what you want your money to do for you. One of the biggest reasons why saving is so difficult is because people do not put away emergency reserves. So stop procrastinating and start thinking ahead.

How does the Money Savings Challenge Work

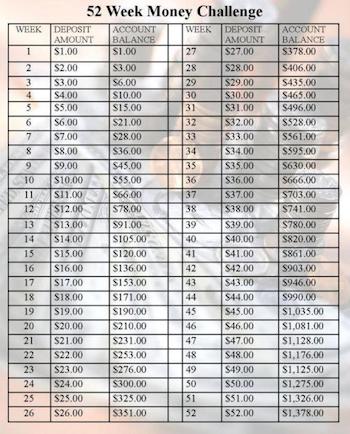

There are 52 weeks in the year and you will need to make a deposit every Saturday starting on January 5, 2019. Based on the multiple you set, you will be expected to deposit those funds into your savings account each week. It is important that you keep the funds in an account that you can’t touch and is separate from your current bank account. For the basic plan, you begin with $1 in week 1, and in week 2 you add $2 and so forth and so on. The biggest amount you will deposit is $52.00 so you can see the amounts you are saving are manageable. At the end of the 52-weeks you will have a total of $1,378 in your savings. A good strategy is to deposit the higher amounts in the beginning while you’re motivated and work your way down.

Now if you want to save even more, you can do different multiples of 2, 3, 4 and even 10. So instead of saving $1 in week one you now save $10. In week 2 you save $20 and so forth and so on. If you try the challenge multiple of 10, you will have a total of $13,780 in your savings at the end of the year. Now I don’t want to scare you so you won’t do this at all. Start out with the original plan, reach that goal and then go from there.

How to Sign Up

If you are interesting in participating, fill out this form. You will receive a weekly email with instructions on how to confirm that you made your weekly goal. This is how we will be accountable to one another as I will be participating in the challenge as well. There is no cost to participate, just be ready to commit from day 1 to day 365.

If you would like like more personal one on one accountability coaching, click here. Ready, get set, go! I hope you are up for the challenge because I am.

How to Lead While Running a Business Remotely

How to Lead While Running a Business Remotely 7 Reasons Why I Try To Do Yoga Everyday

7 Reasons Why I Try To Do Yoga Everyday Go Broke Traveling

Go Broke Traveling